Holiday Spending to Increase 6% in 2025 as Consumers Prioritize Value Over Discounts, According to Simon-Kucher Report

TL;DR

Retailers can gain advantage by offering targeted 40% discounts and value-driven initiatives to meet consumer demand while maintaining profitability during holiday sales.

Simon-Kucher's 2025 report shows consumers plan early, use 2.4 payment methods, and expect category-specific discounts while embracing AI for deal tracking and price comparisons.

Consumers prioritize quality and value over price, fostering more meaningful purchases and reducing returns, which supports sustainable retail practices and better shopping experiences.

54% of shoppers now use AI for holiday support, with social media inspiring 64% of purchases and Black Friday remaining the top sales event.

Found this article helpful?

Share it with your network and spread the knowledge!

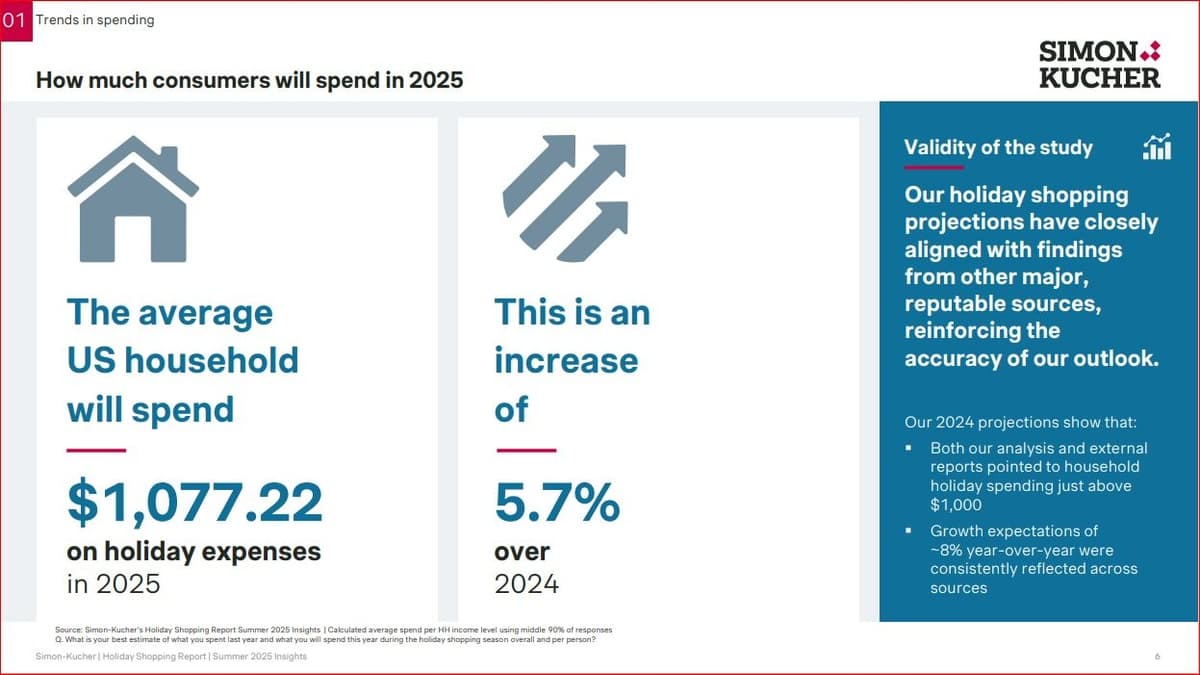

Holiday shoppers are projected to increase spending by at least 6 percent compared to last year, with households budgeting up to $1,077 for seasonal purchases according to Simon-Kucher's 7th Annual Holiday Shopping Report. The comprehensive study reveals consumers are adopting stricter budgets while prioritizing quality and value over price across most categories, signaling a shift in purchasing behavior that challenges traditional discount strategies.

Most consumers expect discounts of up to 40 percent, though discounts around 25 percent remain common across various product categories. Spending patterns show significant category specificity, with over 50 percent of consumers planning to spend more than $100 in high-value categories including household appliances, home improvement, and electronics. Shikha Jain, Partner and Head of Consumer and Retail for North America for Simon-Kucher, noted that holiday sales growth in 2025 will depend on meaningful discounts, with consumers acting decisively to secure deals that may not last.

Purchasing behavior data indicates 66 percent of early holiday shoppers favor Black Friday and other sales events, with shopping beginning as early as the 4th of July through Super Saturday. Social media serves as a source of inspiration and influencer ideas for 64 percent of shoppers, while return rates remain relatively low with three out of four consumers returning 10 percent or less of their purchases. Max Walter, Director of Consumer and Retail for North America, emphasized that today's holiday shopper plans early, seeks social media inspiration, and expects smooth experiences that minimize returns.

Artificial intelligence is gaining mainstream adoption with limitations, as 54 percent of consumers use AI for holiday shopping support, 23 percent utilize it for deal tracking, and 27 percent employ it for price comparisons. However, older generations continue to prefer brainstorming their own gift ideas and choosing not to use AI technology. Tariff disruptions present additional challenges, with 44 percent of consumers expecting at least a moderate impact on holiday shopping and 19 percent opting out entirely due to budget constraints and commercialization concerns.

Payment methods show diversification, with shoppers using an average of 2.4 payment options and 45 percent preferring debit cards as their primary method. The study, conducted between July 25-31, 2025 through an anonymous survey of 1,513 US consumers, analyzed holiday spending per household relative to actual US population distribution by household income level based on US Census data available at https://www.census.gov/data/tables/time-series/demo/income-poverty/cps-hinc/hinc-06.html. Researchers examined both absolute dollar amounts and percentage changes compared to the previous year, excluding 5 percent on each end to focus on the median 90 percent of consumers for accurate representation.

Curated from Reportable